How We Built a Fully Automated Travel Savings & Payments Platform for Drift Plus Adventures (A Quick Office Pointe Case Study)

How We Built a Fully Automated Travel Savings & Payments Platform

A Quick Office Pointe case study for DriftPlus Adventures

Introduction

In 2024, DriftPlus Adventures approached Quick Office Pointe with a simple but powerful idea:

“What if customers could save for trips the same way people save for insurance, school fees, or chama contributions?”

Today, that idea has evolved into one of Kenya’s most innovative travel finance platforms a complete ecosystem that allows travelers to:

- Save gradually for trips

- Set multiple travel goals

- Pay deposits or full amounts

- Automate payments with KCB Bank

- Track booking history

- Transfer savings to a friend

- Manage travel budgets

- View dashboards, analytics, and financial insights

This is the story of how we built it.

The Problem DriftPlus Wanted to Solve

Most customers don’t book trips because:

- They cannot pay the full amount at once

- They forget payment deadlines

- They lack a structured way to save

- They fail to track instalments

- Manual M-Pesa confirmations slow down bookings

As a result:

- Adventure travel conversions drop

- Trips fill slowly

- Follow ups take time

- Customers lose motivation

Drift Plus Adventures needed a financial technology solution, not just a website.

Designing a Travel Savings Ecosystem

Quick Office Pointe built a solution with these pillars:

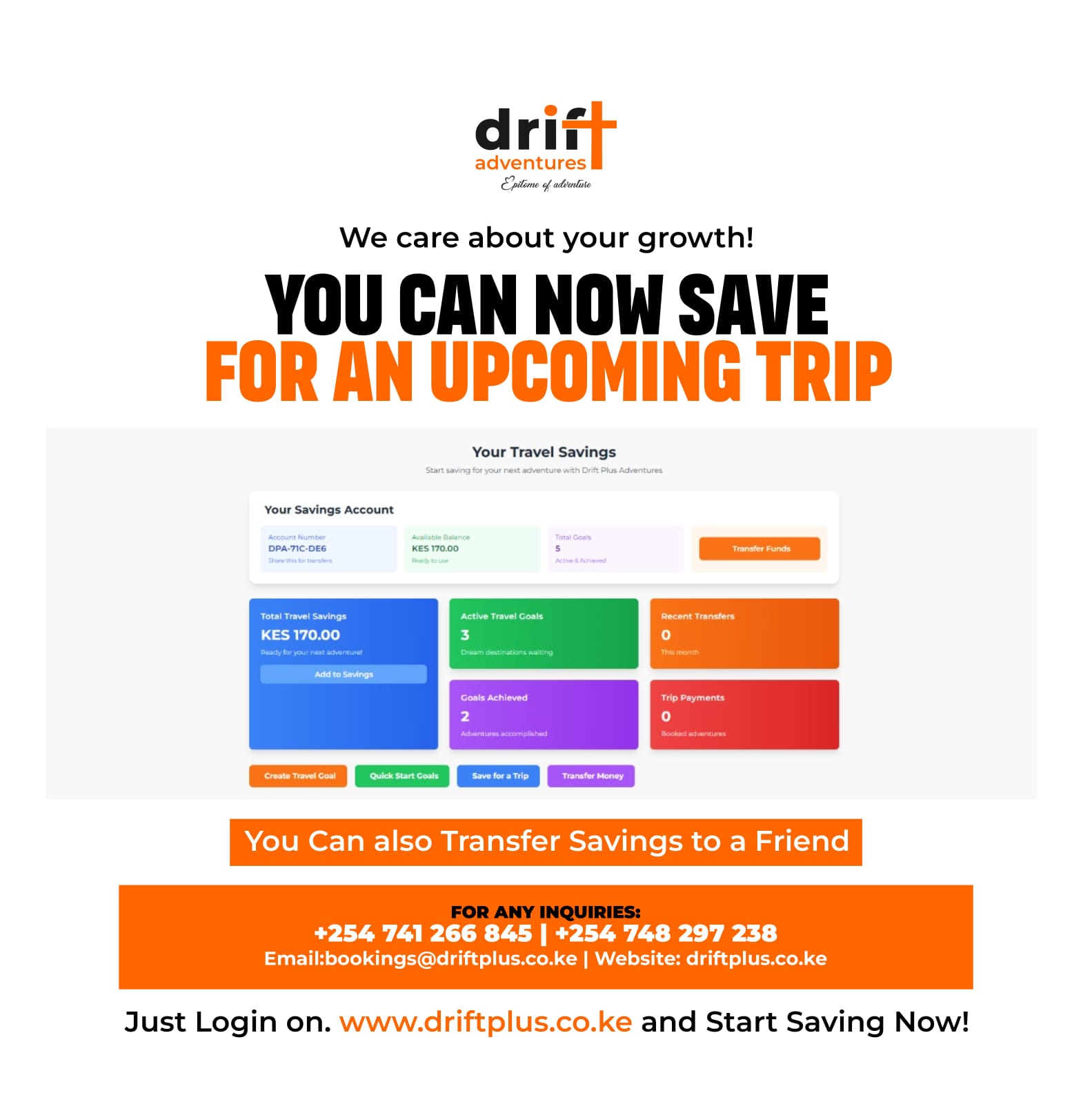

1. Personal Savings Wallet

Every user gets a DriftPlus Travel Wallet with:

- Account number

- Available balance

- Total savings

- Savings history

- Transfer option

This wallet acts as a mini-fintech account dedicated to travel.

2. Automated Travel Goals

Users can set multiple goals like weekend getaways, international trips, day trips or dream destinations. Each goal shows:

- Target amount

- Saved amount

- Remaining balance

- Progress percentage

- Days left

This motivates consistent saving and boosts trip conversions.

3. Seamless Booking + Payments

Whether a customer wants to:

- Pay a deposit

- Pay in full

- Pay using their savings wallet

- Pay via automated KCB payment gateway

The system handles everything instantly.

4. Automated Payment Integration (KCB Bank)

This is where the platform becomes fintech-grade. The system supports:

- Auto-reconciliation of payments

- Instant confirmation

- Real-time dashboard updates

- Error-free financial tracking

- Automatic deposit-to-wallet posting

- Security and audit logs

No human intervention. No delays. No mismatches.

5. Advanced Travel Dashboard

Users can track:

- Total paid

- Pending balance

- Completed payments

- Monthly averages

- Payment trends (graphs)

- Distribution charts by product type

- Previous and upcoming bookings

This transforms the travel experience from transactional to financially empowering.

User Experience (UX) Highlights

Your screenshots show the evolution from a booking system to a full personal finance tool for travellers:

- ✔ Modern, clean UI

- ✔ Visual dashboards

- ✔ Easy booking with modals

- ✔ Multiple payment pathways

- ✔ Intelligent savings prompts

- ✔ Travel wishlist, reviews, buddies

- ✔ A full customer mini-portal

This is no longer just a tour company website it is a lifestyle platform.

Business Impact for DriftPlus Adventures

- Higher Trip Conversion Rate — Customers now book even when they can’t pay in full.

- Consistent Cashflow — Savings accumulate daily/weekly/monthly.

- Better Customer Loyalty - Users stay longer since travel goals keep them engaged.

- Reduced Support Load - Automated confirmations & dashboards mean fewer calls.

- More Payment Options - Deposit, full payment, savings, bank automation - all in one place.

- Brand Positioning - Drift Plus Adventures is an innovative travel brand with a smart savings + booking ecosystem.

Technical Architecture

(High-level overview for potential Quick Office Pointe clients)

- Frontend: HTML, CSS, Tailwind, JavaScript

- Backend: Laravel

- Database: MySQL

- Payment Integration: KCB Automated Payments

- Security: Two-factor logic, encrypted transactions

- Dashboards: ChartJS, dynamic APIs

- Scalability: Modular savings engine, ready for mobile app

Why Companies Choose Quick Office Pointe

We don’t just build websites - we build systems that transform business processes. This platform shows what’s possible when:

- UX design

- Software engineering

- Automation

- Business strategy

If your business needs automated payments, customer wallets, goal-based saving tools, booking platforms, dashboards & analytics, a mobile app or a fintech-like web system - Quick Office Pointe can build it.

Conclusion

The Drift Plus Adventures Savings & Payment Ecosystem is proof that innovation wins. A travel company can become a fintech brand. A booking system can become a financial empowerment tool. A simple idea can become an entire digital ecosystem.

And this is just the beginning.

Want a custom web platform that automates payments, boosts conversions, and transforms your business?

Talk to Quick Office Pointe today.

Contact Quick Office Pointe